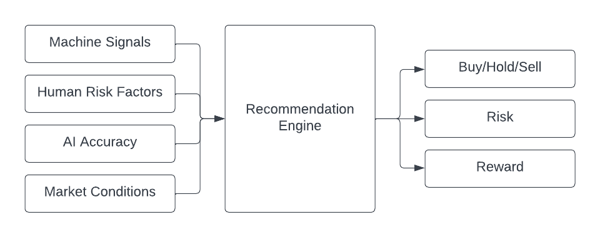

A breakdown of Boosted.ai's recommendation engine.

Boosted.ai’s recommendation engine evaluates a combination of inputs such as Machine Signals, AI Accuracy, Market Conditions, and Human Risk Factors to predict risk and reward. It then surfaces outliers that present investment opportunities and recommends a Buy, Sell, or Hold (Neutral).

Inputs:

- Machine Signals - These are the bullish and bearish signals generated by variables and patterns (machine-learned behaviors) the machine learned during its training. The machine uses these signals to predict performances and rank stocks accordingly.

- AI Accuracy - Because machine signals are updated during retraining periods, there is a chance that the variables and patterns previously learned are not effective in predicting performance in the live environment due to regime shifts and other influences. AI Accuracy shows how accurate the variables and patterns are in predicting performance in real time.

- Market Conditions - Similar to AI Accuracy, Market Condition is a live performance metric. It measures how stocks that share similar predictive patterns perform in the current market. For example, if the machine learned to rate stocks with growth patterns highly but growth stocks are greatly underperforming in the current market, then the Market Condition score would likely be very low.

- Human Risk Factors - Human risk factors are traditional factors such as value, momentum, growth, volatility, dividend yield, etc.

Buy/Hold/Sell Recommendation

.png?width=450&height=178&name=image%20(73).png)

Outputs:

- Risk - The probability of the stock attaining the predicted excess return. Risk is assigned Very High, High, Average, Low, and Very Low, with high risk meaning a low probability of attaining the predicted return and low risk meaning a high probability of attainment.

- Reward - The excess return a stock is expected to have over the benchmark. Similar to Risk, Reward is also assigned Very High, High, Average, Low, and Very Low, with high reward meaning high excess return and low reward meaning low or negative excess return.

- Buy/Hold/Sell - The machine evaluates a stock's rating as well as interesting predictive patterns that have historically led to outperformance/underperformance to provide a Buy/Hold/Sell recommendation.

When the machine makes a buy or sell recommendation, it is due to one of two reasons: trend following or mean reversion.

- Trend Following - Trend Following means that a stock’s bullish or bearish signals generated from learned patterns are still accurate in current market conditions. If you believe the machine will continue to be accurate, then you should consider the recommendation.

- Mean Reversion - Mean Reversion opportunities are presented when a stock's bullish or bearish signals are the opposite of what you might intuitively expect. For example, if the stock has low momentum and a high rating, that implies the machine thinks that the recent downtrend in the stock is going to reverse.