Understand how Earnings Summary works

Overview

Earnings Summary allows you to instantly get all the information you need from company earnings calls. Boosted Insights allows you to compare calls from different quarters, automatically identifies important similarities and differences, and informs you of the potential sentiment toward your selected security.

How it works

Earnings Summary starts by reviewing an earnings call transcript and splitting out its information into two sections: remarks and Q&A (questions and answers). Boosted Insights then pulls out the main points of each section, understanding what’s important based on the following criteria:

- Remarks: Focuses on financial updates, and discussions about products, projects, services and/or initiatives for the company

- Q&A: Focuses on what the analysts are asking, and the surface-level confidence in which the company responds.

From there, it generates a list of main ideas for each section and a summary for each idea that it surfaces.

Sentiments

After Boosted Insights pulls out the main ideas in both the remarks section and the Q&A section, it assigns each idea a sentiment based on the information provided within the earnings call.

Sentiments can be positive, neutral or negative.

- Positive sentiment: Means that the main idea is good for the underlying company.

- Neutral sentiment: Means that the main idea is neither good nor bad for the underlying company.

- Negative sentiment: Means that the main idea is bad for the underlying company.

Boosted Insights determines the remark’s positive or negative sentiment by analyzing its summary. From there, it determines whether the sentiment is positive, negative, or neutral.

Comparing remarks between two earnings calls

Earnings Summary gives you a side-by-side view of the two most recent earnings calls for the company.

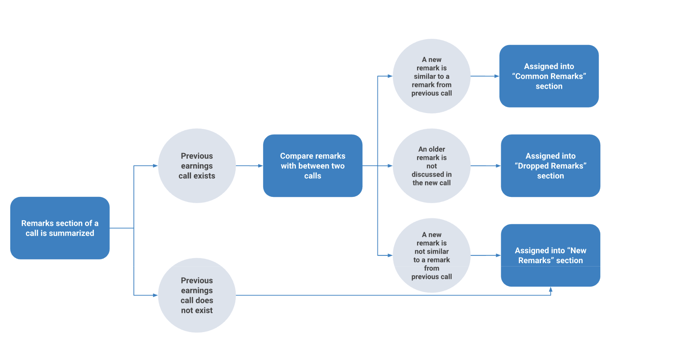

When comparing two earnings calls, Boosted Insights identifies and sorts remarks into three categories:

- Common remarks

Common remarks refer to remarks appearing in both earnings calls that you’re comparing. Common remarks allow you to trace the story of a particular remark to see how it evolves over time.

- Dropped remarks

Dropped remarks refer to remarks appearing in the older call that you’ve selected, but not the more recent call. Dropped remarks indicate that they’re no longer important topics of conversation for the company. - New remarks

New remarks refer to remarks appearing in the most recent call that you’ve selected, but not in the older call. New remarks allow you to understand what new ideas are being brought to the table and what they mean for the underlying company.

Note: Some companies, such as PepsiCo Inc. (PEP) and Netflix Inc. (NFLX) don’t have remarks in their earnings calls. In these cases, we won’t show common remarks in the earnings summary.

The flowchart below shows a visual representation of how Earnings Summary remarks are sorted into different categories.

Summarized comparison

Alternatively, in the summarized comparison, Boosted Insights considers all remarks made in the two calls that you’re comparing. This includes anything considered a new remark or a dropped remark.

The summarized comparison pinpoints key differences in the company’s position between the two quarters to give you a high-level understanding of what has changed between the two earnings periods.

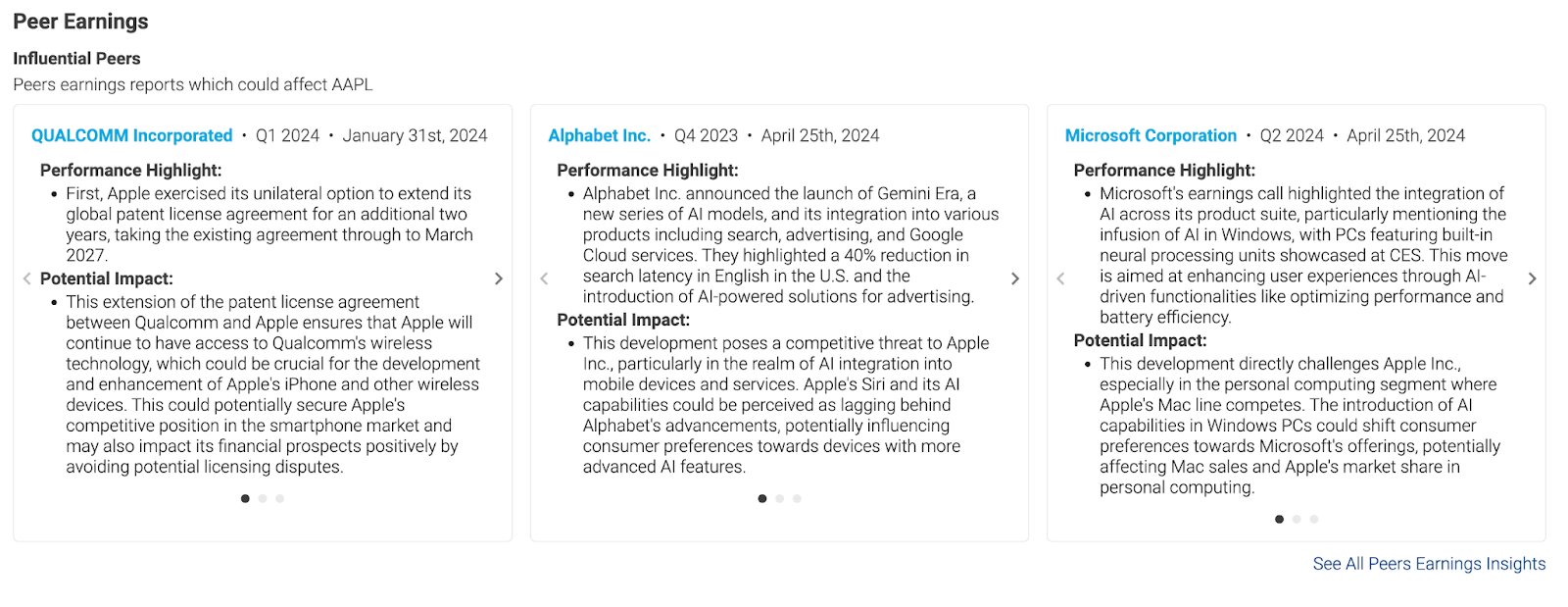

Peer Earnings

Peer earnings are earnings from other companies that are likely to be impactful on the security you’re viewing. With it, you get a summary of the peers' performance in their last earnings report along with a prediction of the potential impact on your security

Impact on Others

Impact on Others

Opposite to Peer Earnings is the security’s impact on other companies.