Learn how to use Boosted.ai Hedge Basket to construct AI-powered hedge baskets.

What is Boosted.ai Hedge Baskets?

Boosted.ai Hedge Baskets is a powerful feature that enables your team to generate intelligent hedges within minutes. We use our proprietary ML technology to construct hedge baskets that offset unique portfolio risks and outperform simple beta hedging. Now, you can own your hedging process without the cost of building a team.

Hedge Baskets 101

- Building a Hedge Baskets Experiment

- Hedge Baskets Scenario Settings

- Evaluating Hedge Baskets Results

Building a Hedge Baskets Experiment

Hedge Baskets Scenario Settings

- [Trading] Rebalance Period - How frequently do you want the hedge basket to re-compute?

- [Trading] Trading Cost - What is the preferred trading cost you want to use for the hedge basket?

- [Trading] Reduce Minor Trading - Enable minimum trade size cutoff to reduce the number of small trades. For example, if at 0.5%, if any holding has less than 0.5% being traded on the date of rebalance, that trade will not occur. Note that using this can lead to allocations below your ideal allocation % - since some trades will not occur.

- [Filters] S3 Data Filters - We’ve partnered with S3 to incorporate short interest and borrow data into Hedge Baskets to ensure your hedges are tradable. By default, the machine will only choose stocks whose short interest percentage <=50% and short borrow rate <=10%. You can change this by typing in a new upper or lower bound.

- [Filters] Reporting Stocks - Use the filter to exclude names reporting earnings from your hedge basket. Please keep in mind that many stocks report quarterly, so setting a value too large may cause issues. A typical value is 30 days, assuming a monthly rebalance.

- [Basket Trading] Optimizer - You can switch Hedge Method from Simple to Optimizer to optimize your basket to minimize VaR or Volatility.

- Basket Trading] Basket Size - Set the number of names in your hedge basket. Generally, larger baskets yield lower volatility but also lower returns.

- [Basket Trading] Weightings - You can control the hedge generation process by adjusting the different factor weights and other toggles.

-

- Price Weight (Slider) - How important the price similarity scores generated from Machine Factors are in constructing the baskets.

- Factor Weight (Slider) - How important the traditional, non-machine factors are in constructing the baskets.

- Beta Weight (Slider) - How important beta is in constructing the baskets.

- ESG Weight (Slider) - How important the ESG factors are in constructing the baskets. Unless your portfolio is ESG sensitive this slider can be set to None however is an option.

- Turnover Importance (slider) - You can control the importance of the hedge's turnover by toggling turnover important. The higher the toggle, the lower the turnover will be.

-

- Signal Importance (Slider) - How important the input signals from a model are in constructing the baskets. This usually has minimal impact on the portfolio generated however, is an option.

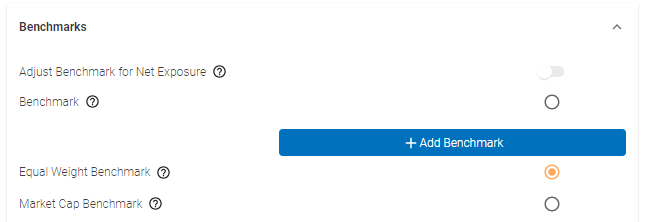

Benchmarks - this is important as it will define the risk factor model used in your hedge basket.

| Benchmark | Set one or more benchmarks and the weightings for each. |

| Equal Weight Benchmark | Instead of using the defined benchmarks, set the benchmarks to be an equal weighted (per rebalance period) version of the stock universe. |

| Market Cap Benchmark |

Use a market cap weight of your stock universe as your benchmark. This will be done using the point in time universe rather than the benchmark security you selected. |

Evaluating Hedge Baskets Results

- Click into your experiment to see your hedge baskets. Your hedge basket performances can be shown in absolute values or relative to your baseline portfolio, which you can sort by clicking the top of the column. You can also evaluate all baskets together or within the scenario by switching the toggle between Flat View and Group View.

![]()

- Select a hedge basket to see its construction and its performance against the baseline over time. To do a deeper analysis, you can export your basket as a CSV using the Excel icon or clicking on the model next to your basket’s name.

- You can rerun any scenarios or add new scenarios to optimize your hedge baskets.

Log into Boosted Insights to start using Hedge Baskets today. If you have any questions, reach out to your Customer Success Manager.