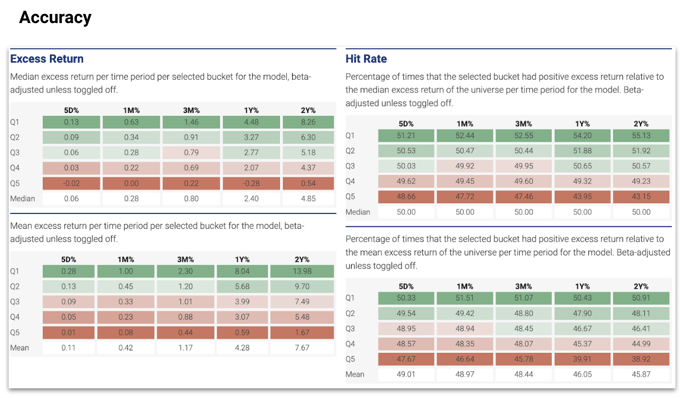

As covered previously, you can find Excess Return and Hit Rate in Accuracy to see your model’s performance.

To measure how well your signals are doing:

- Long Portfolios - You’d want to see high, positive excess return and hit rate >50% in your top bucket (Q1, D1, or V1 depending on your breakdown).