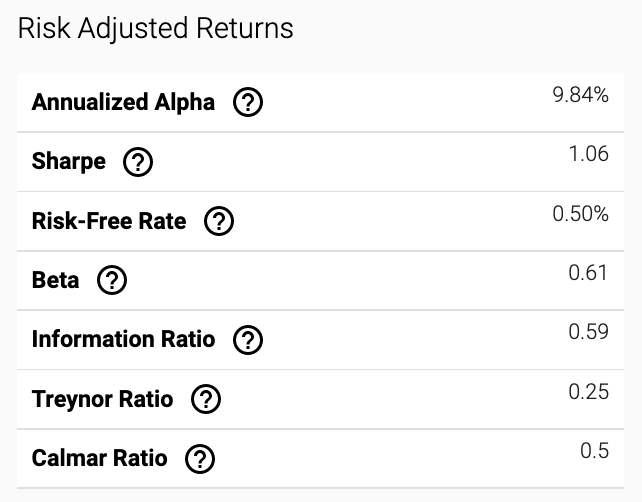

On your the Tearsheet of your model, you will see a separate column with the returns metrics

The annualized Alpha is the

Annualized Return - Risk Free Rate - (Beta x (Benchmark Annualized Return - Risk Free Rate))

The active return on an investment, or the performance of that investment compared with a suitable benchmark(s). An alpha of 1% means the return on investment over a selected period of time was 1% better than the market during that same period; a negative alpha means the investment underperformed the market.

Most investors will also view the annualized alpha together with over metrics such as Volatility, Sharpe and Beta.