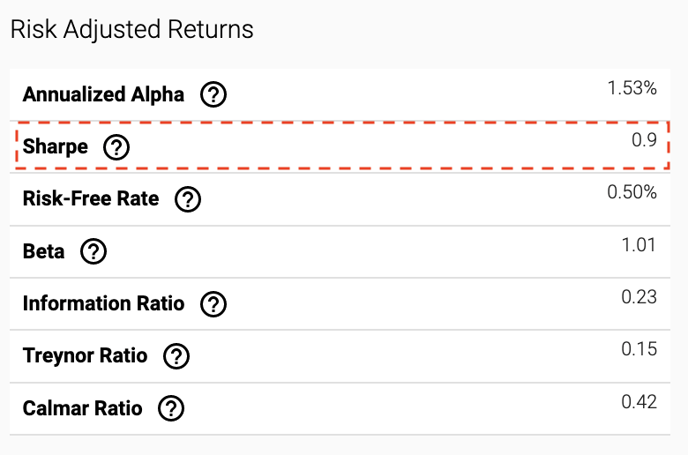

On the risk adjusted returns of your tear sheet you will see the Sharpe Ratio.

The Sharpe ratio is calculated as follows

(Annual Return - Risk Free Rate) / Standard deviation of Portfolio

Sharpe measures the performance of an investment (e.g. a security or portfolio) compared to a risk free asset, after adjusting for its risk.

Risk Free Rate is the rate of return of a hypothetical investment with scheduled payment(s) over a fixed period of time that is assumed to meet all payment obligations. It is usually represents the interest on an investor's money that would be expected from an absolutely risk-free investment over a specified period of time.

| Guidance Sharpe Ratio | |

| Between 1 and 2 | Good |

| Between 2 and 3 | Very Good |

| Greater than 3 | Excellent |