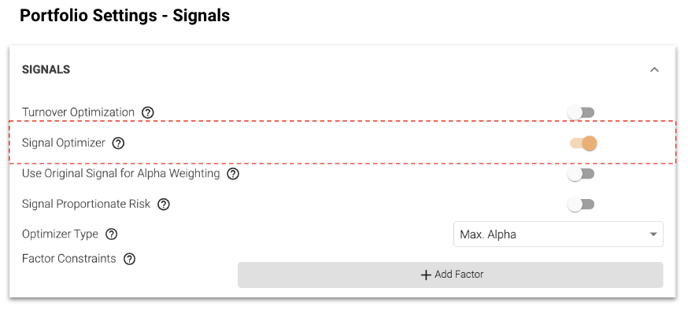

Within portfolio settings, you can turn on Signal Optimizer for backtested portfolios. With this feature turned on, it will reduce signal strength, thus reducing volatility of drawdowns.

Use to eliminate factor (momentum, size, volatility, etc.) bias in your signal, especially if those factors cannot be eliminated by portfolio optimization.

For example, if the signal has a strong bias towards size and your long book only trades the top 20% of ranked stocks, it is very unlikely that portfolio optimization will be able to eliminate this bias.

Note, if a model has good signals and a good spread, signal optimization will not improve the spread; it can even lower performance.

Once Signal Optimizer is on, you can enable Alpha Weighting, Signal Proportionate Risk, Optimizer Type, and Factor Constraints.

Beware that only "Max Alpha (v1)" and "Min Vol (v1)" support "Signal Proportionate Risk".

We recommend that "Min Drawdown" and "Max Information ratio" should be used for long only portfolios in the current implementation. They are similar to a tracking error optimizer and will return results that are similar to the market cap weight of the universe. We are actively working on features that will allow user-specified weightings between alpha and tracking errors.

Calculation

Signal Optimization is implemented as a constrained optimization problem where an objective function is optimized subject to user specified constraints on factors and maintaining the same statistical distribution as the unoptimized signal.

Max Alpha maximizes exposure to the signal, this is the base objective function defined as: (Optimized Signal - Unoptimized Signal)^2

Minimize Volatility minimizes the Signal-weighted variance as an additional term to the Max Alpha objective function, this is defined as: Signal Vector * Returns Covariance Matrix * Signal Vector Transpose.

The optimizer will minimize the objective function while respecting user-specified factor constraints and maintaining the same distribution of signals.

Different Optimizers

- Max Alpha: Maximizes exposure to the signal. V2 is the updated version with way faster speed and higher accuracy.

- Min Volatility: Minimizes the Signal-weighted variance. V2 is the updated version with way faster speed and higher accuracy.

- Min Drawdown: Optimizes for reducing Drawdowns relative to the market cap weighted universe.

- Max Information Ratio: Maximizes tracking error adjusted return.

The optimizer will minimize the objective function while respecting user-specified factor constraints and maintaining the same distribution of signals.