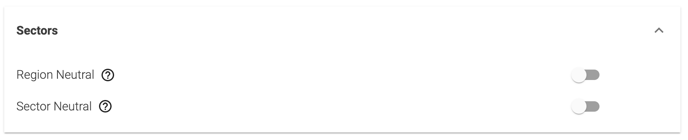

If your portfolio is not performing well despite having a good model you can try creating a portfolio that is region or sector neutral. This will typically decrease volatility as the portfolio is less exposed to sector or region-specific risks. Note that region and sector neutrality are mutually exclusive.

If either setting is turned on, the portfolio will be constructed as a series of portfolios - each matching the market cap weighting each of the stock universe 'regions' or 'sectors'. This means that minimum and maximum number of stocks per portfolio becomes 'per region' or 'per sector'. However, maximum position sizes in percentage points is absolute and should not be changed as sector or region neutrality is toggled.

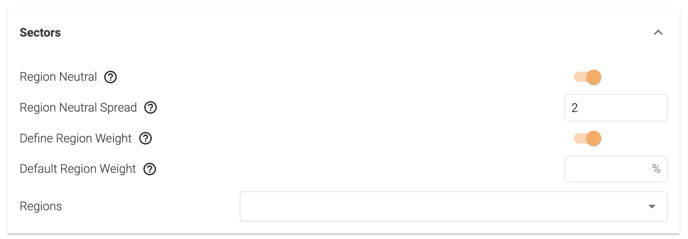

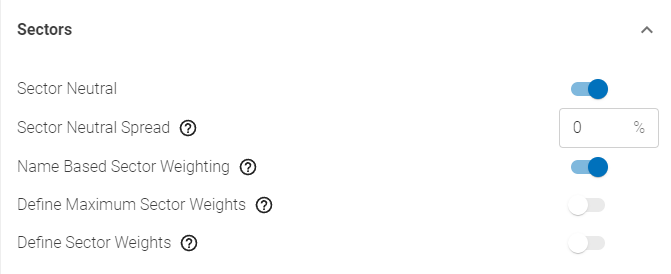

The region or sector neutral spread is how far away from the benchmark region or sector allocation the machine can deviate expressed in percentage points. This is adjusted for net exposure, i.e. if your net exposure is 0%, the target region or sector allocations will be 0%. If the region neutral spread is 2 then the target allocation will be allowed to deviate between -2% and +2%.

For region neutrality there are also additional options to specify the a target weight for each region.

For sector neutrality the user can specify a sector weighting based on the count of companies in each sector instead of a market-cap weight. Similar to region neutrality, the user can choose the maximum and target weights for each sector.