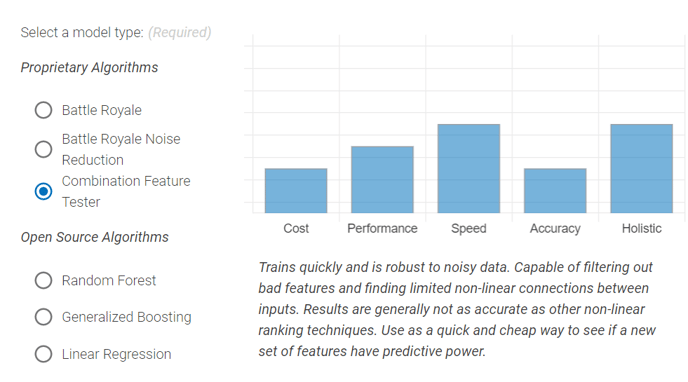

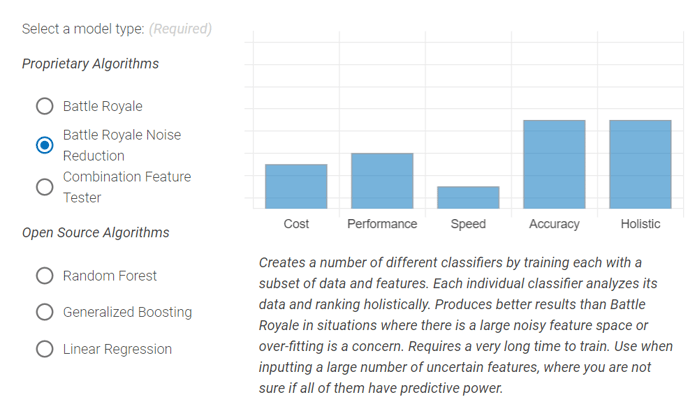

What is the best algorithm to select?

It depends on your goals - the best algorithm to use will depend on how many credits you want to spend, how comfortable you are with your feature selection, and what stage you’re at in model building. For your first models we recommend using the Combination Feature Tester - it is cheap, it does an effective job of eliminating feature noise, and it is relatively performant. Once you have a set of features that you are comfortable with, and you feel comfortable that the performance of your Combine Feature Tester model is good - we recommend building a Battle Royale or Battle Royale Noise Reduction. These algorithms are more expensive than Combination Feature Tester, but are generally more performant.

Which algorithms were created by Boosted and which ones are from “off the shelf” standard libraries?

Battle Royale or Battle Royale Noise Reduction are algorithms created in-house by Boosted’s machine learning team. Random Forest, Generalized Boosting or Combination Feature Tester are created from off the shelf standard machine learning libraries.

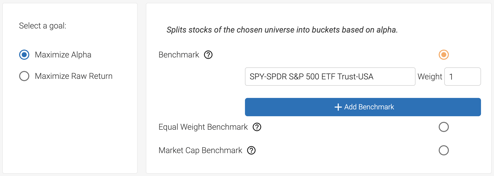

What is the best goal to use?

The best goal to use is typically Maximize Alpha. The “alpha” means that the algorithm is trying to optimize for alpha instead of raw return, possibly reducing the volatility and beta of the selections.

Can you select more than one index at once?

Yes you can select more than one index at once by using the “Stock Search” functionality. Click Stock Search on the Stock Universe page and then select Index and any indices you want to use.

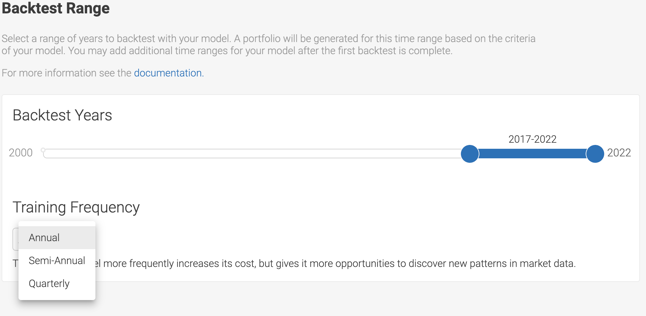

My backtest only lets me go back to a certain date - why?

Backtests are limited to where we feel we have good quality data. We need to have data for almost a decade prior to each backtest period, so a backtest from 2004 - 2021 actually needs data from 1994 in order to properly train. If you have chosen a benchmark or index where we do not have good membership data, your backtest will be restricted. In addition, we do not allow backtests before 2000 as the quality of the data before 1990 doesn't fit our standards.

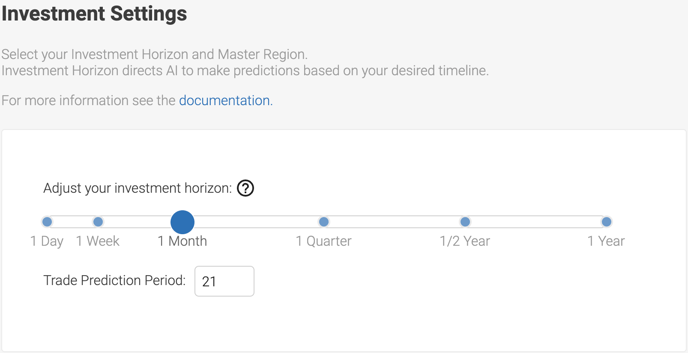

What does selecting an investment horizon do that's different than the rebalance period?

Rebalance period is how often your model will trade, while investment horizon is the time period the machine is optimizing returns for.

If it's rebalancing weekly does it make sense to have a 1 year horizon?

You can have a 1 year horizon and a daily or weekly rebalance - what is happening though is the machine is trying to find the stocks that it thinks will do best over the next year. However, the machine may solve the 1 year problem very well, but your portfolio results might not be that good because of the shorter rebalancing. In these situations we recommend that you try multiple different portfolio construction options, including adjusting the rebalance frequency and adjusting the signal smoothing. These options can all be adjusted after your model is complete and do not require the creation of a new model.

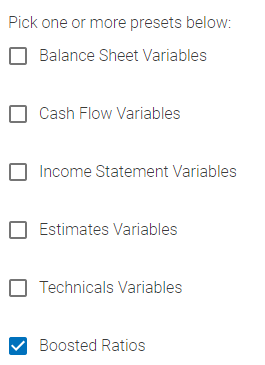

What are the Boosted ratios?

Boosted Ratios are a set of variables that we have good general success with across multiple universes. They make a great starting point for constructing your first models.

How do I know what variables to select?

You should select variables that you think make the most sense and that you use in your normal process of evaluating companies. For example, if you look at revenue growth then select something like 1 Quarter % Change in 1 Quarter revenue. If that is too short, then select 1 Year % Change in 1 Year revenue … or select both! The explainability that is created after the model trains will help you determine which variables were useful or not and you can change the variables on your next model build.

What if I can’t find the variable I’m looking for?

Try slightly different search terms, if you’re looking for EBITDA it might be EBIT&DA or something like that. So try making your search more simple to expand the results. If you still cannot find the variable you are looking for, there is a chance that we do not have that data. If you have the data yourself then you can try uploading it using our Custom Data Upload functionality.

How does the credit system work?

Each model costs a certain amount of credits to run. The number of credits is determined primarily by the type of model, the size of the universe, the backtest range, the training frequency and the number of variables. We use credits because we incur computing cost when new models are trained (but not when new tabs are created on an existing model). It keeps us from incurring large costs if more large models are being built than we anticipate. Please reach out to us if you are running low on credits at any point.