Test different Strategy settings to achieve the portfolio results you're looking for. Strategy settings are best altered when you have already created a strategy with strong quantile performance (Q1 - Q5).

Strategy Settings can be layered on top of an existing machine learning model to generate new portfolios for every given model. For example, with one model you could have a 130% long and 30% short strategy setting in addition to a 100% long and 0% short strategy setting. This will create two separate and distinct portfolios based off of the selections of the original model.

Changing strategy settings comes at no additional credit cost. Experimenting with different strategies allows you to see how your strategy would perform using different trading and allocation rules. Changing or adding a strategy doesn’t stop existing live strategies that work off the same model. You can change the strategy settings of live models, though they will take some time to update (varies depending on number of stocks and duration of backtest).

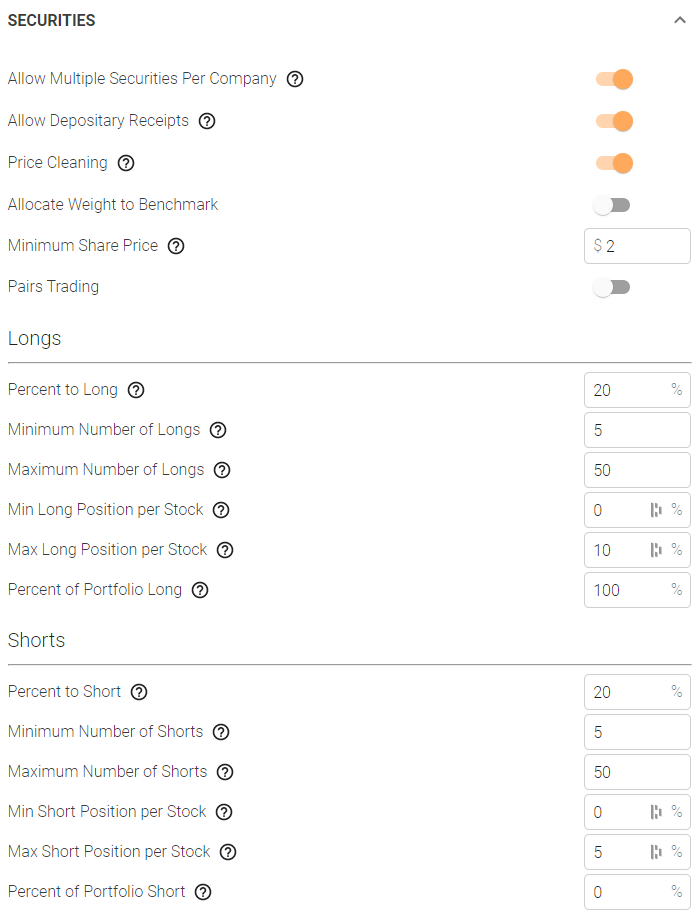

SECURITIES BREAKDOWN

| Description | |

| Allow multiple securities per company | Allows the machine to trade multiple securities (at the same time) for the same company. If it is ON and a company has listed PREF shares and COMMON shares both will show up as tradeable options for that company. If it is OFF then system will try to determine the "correct" security to trade based on volume, liquidity, and share type. |

| Allow depositary receipts | Companies with tickers ending in .Y and .F will be disallowed from trading within the model with this setting off. Turn it on to allow trading in these securities. |

| Price cleaning | Price Cleaning removes any very large price movements from the securities, specifically with a daily change greater than +500% or -83.33%. There are some legitimate securities with moves this large that will be impacted by turning this on, but the advantage is it prevents these securities from overwhelming the backtest. |

| Allocate weight to benchmark | Enables part of the model weight to be allocated to benchmark. |

| Benchmark Allocation: weight to allocate to benchmark | |

| Minimum Share Price: The minimum share price you want the portfolio to allow. | |

| Minimum share price | The minimum share price you want the portfolio to allow. |

| Pairs Trading | Pairs Trading forces the portfolio to be created by going long / short an equal number of stocks. The portfolio will try to find an offsetting position for every long by finding securities that are both highly correlated and have a significant difference in star rating. |

| Longs | |

| Percent to long | The machine will attempt to buy the top X% of stocks, subject to the minimum and maximum specified. This is on a per “portfolio” basis, so if you have sector neutral turned on it will be top X% per sector. |

| Minimum number of longs | The minimum number of stocks to buy. This is on a per “portfolio” basis, so if you have sector neutral turned on it will be minimum per sector. |

| Maximum number of longs | The maximum number of stocks to buy. This is on a per “portfolio” basis, so if you have sector neutral turned on it will be maximum per sector. |

| Min. long position per stock | The minimum weighting of a long position within the portfolio. |

| Max. long position per stock | The maximum weighting of a long position within the portfolio. |

| Percent of portfolio long | The exact sum of all long position weightings in the portfolio. |

| Shorts | |

| Percent to short | The machine will attempt to short the bottom X% of stocks, subject to the minimum and maximum specified. This is on a per “portfolio” basis, so if you have sector neutral turned on it will be bottom X% per sector |

| Minimum number of shorts | The minimum number of stocks to short. This is on a per “portfolio” basis, so if you have sector neutral turned on it will be minimum per sector. |

| Maximum number of shorts | The maximum number of stocks to short. This is on a per “portfolio” basis, so if you have sector neutral turned on it will be maximum per sector. |

| Min. short position per stock | The minimum weighting of a short position within the portfolio. |

| Max. short position per stock | The maximum weighting of a short position within the portfolio. |

| Percent of portfolio short | The exact sum of all short position weightings in the portfolio. |

EVALUATION BREAKDOWN

| Description | |

| Portfolio starting value | The value of the portfolio when it begins trading. If its backtest spans from 2005 - 2020, the starting value in 2005 will be whatever you set here. |

| Compound returns | When toggled on, this will allow the portfolio to compound returns. |

| Currency | The currency you would like your portfolio to be calculated in. Note that if the currency differs from its exchange (i.e. GBP on the S&P), the prior close foreign exchange rate will be used for calculations. |

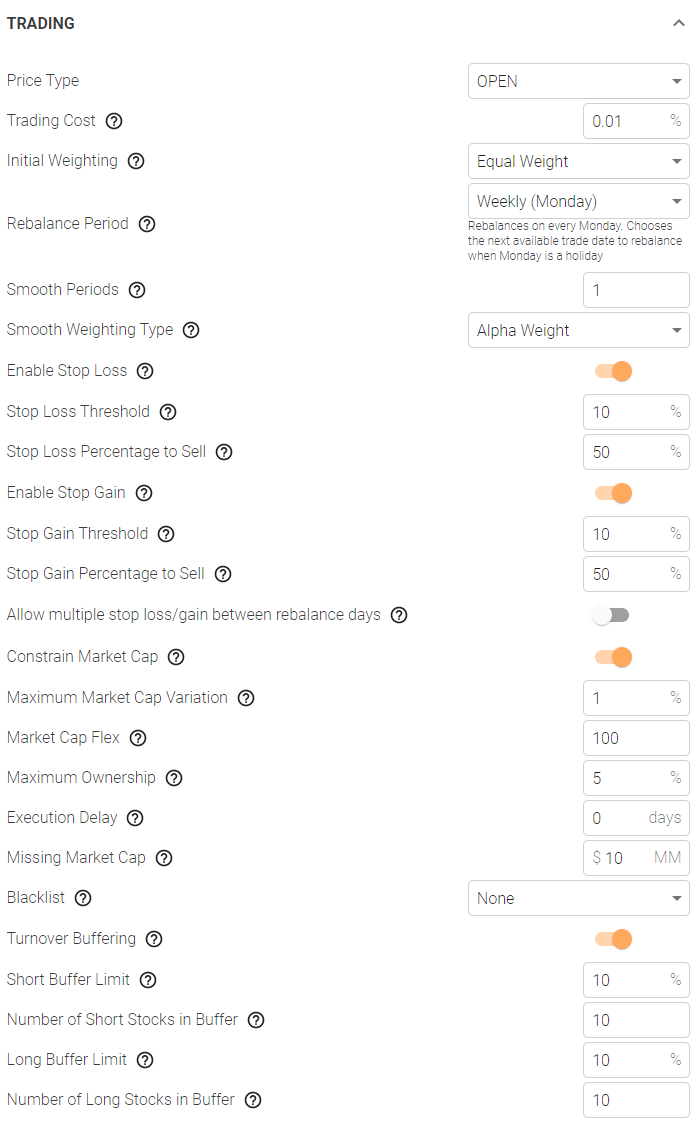

TRADING BREAKDOWN

| Trading | Description |

| Price Type | Price to use for trading |

| Trading cost | A cost that will be applied to every trade. |

| Initial weighting | Alpha Weight: The initial weighting will be done such that higher ranked stocks have a higher weight. |

| Equal Weight: The initial weighting will be done such that all stocks selected to be in the portfolio will have an equal weight. | |

| Market Cap Weight: The initial weighting will be done such that all stocks are weighted according to their previous day’s market capitalization. | |

| Rebalance period | When the machine rebalances the portfolio. You can choose a specific day if you prefer to execute trades on a specific day. |

| Smooth periods | The number of periods over which to smooth the signals. See FAQ on portfolio optimization for more details. |

| Smooth weighting type | Alpha Weight: The strength of the signal matters in the smoothing. For example, if a stock had a score of 5 stars in period A, 2 stars in period B, your 2 period smoothing would be 7 / 2 = 3.5. |

| Equal Weight: Only the direction of the signal matters here. For example, if you were 5 stars in period A and 2 stars in period B, your 2 period smoothing would be 0 / 2 = 0 (+1 in period 1 and -1 in period 2) | |

| Enable stop loss | Turn on stop losses for the portfolio. This forces sales of securities that have exceeded the stop loss level. All trades will occur at the next trading time (i.e. next day OPEN for OPEN price models). |

| Stop loss threshold | Will sell positions after they hit a threshold. For example, 10% / stop loss, when a position loses 10% the machine will sell a portion of the position (defined by stop loss percentage). |

| Stop loss percentage to sell | The percentage of the position the machine will sell if the stop loss is triggered. |

| Enable Stop Gain | Turn on stop gains for the portfolio. This forces sales of securities that have exceeded the stop gain level. All trades will occur at the next trading time (i.e. next day OPEN for OPEN price models). |

| Stop gain threshold | Will sell positions after they hit a threshold. For example, 10% / stop gain, when a position gains 10% the machine will sell a portion of the position (defined by stop gain percentage). |

| Stop gain percentage to sell | The percentage of the position the machine will sell if the stop gain is triggered. |

| Allow multiple stop loss/gain between rebalance days | Allows the machine to repeatedly trigger stop losses within a rebalance period. For example, if you trade Mondays and the stock drops 15% per day during the week and the stop loss trigger is 10%, then every day will trigger the stop loss. If toggled off the stop loss can only be triggered once per stock per rebalance period. |

| Constrain market cap | Force weighting to be near the target weights for a market cap weighted index of your entire stock universe. |

| Maximum market cap variation | How far from the target market cap weighted index each stock can deviate (positive or negative). |

| Market cap flex | How far from the target market cap weighted the stock can deviate relative to the existing weight (i.e. at 75% a 1% position cannot exceed 1.75%) |

| Maximum ownership | The maximum percentage of a company the portoflio is allowed to own. For example, if a company had a market cap of $100MM and this was 5% the portfolio could not own more than $5MM of that company. |

| Execution delay | This option adds the number of days selected to the trade execution. If you select T+1 and your rebalance period is set to Weekly (Monday), it will trade on Tuesday, and so on. |

| Missing market cap | The amount in millions (MM) to replace any missing market capitalization information with. This will impact the maximum ownership setting. |

| Blacklist | None: No blacklist usage. |

| Company: Respect the blacklist for your organization. | |

| Model: Respect the blacklist created for this model only. | |

| Both: Respect the blacklist created for this model and your organization. | |

| Turnover Buffering |

Turnover Buffering is a technique used to reduce the turnover of a portfolio. The long / short number of stocks will still be respected, but the technique used will change. For example, if the portfolio was to be long a maximum of 50 stocks the stocks in the final portfolio would be: a) the stocks that are in the top 50 ranks on that day and were in the long portfolio last rebalance period b) the top N stocks (by rank) not already in the portfolio where N is the long buffer limit c) the top ranked stocks that were in the portfolio last rebalance period and are ranked in the top K% of stocks, where K is the long buffer limit. See FAQ on Optimization for further details. |

| Short Buffer Limit: The turnover buffer will use this number to determine the hard cutoff to not include in the short portfolio. If set to 25% it will only allow the bottom 25% of stocks to appear in the portfolio, similar to Percent to Short (which should be lower than this number). | |

| Number of Short Stocks in Buffer: How many "new" shorts the turnover buffer will ideally allow per rebalance period. | |

| Long Buffer Limit: The turnover buffer will use this number to determine the hard cutoff to not include in the long portfolio. If set to 25% it will only allow the top 25% of stocks to appear in the portfolio, similar to Percent to Long (which should be lower than this number). | |

| Number of Long Stocks in Buffer:How many "new" longs the turnover buffer will ideally allow per rebalance period. |

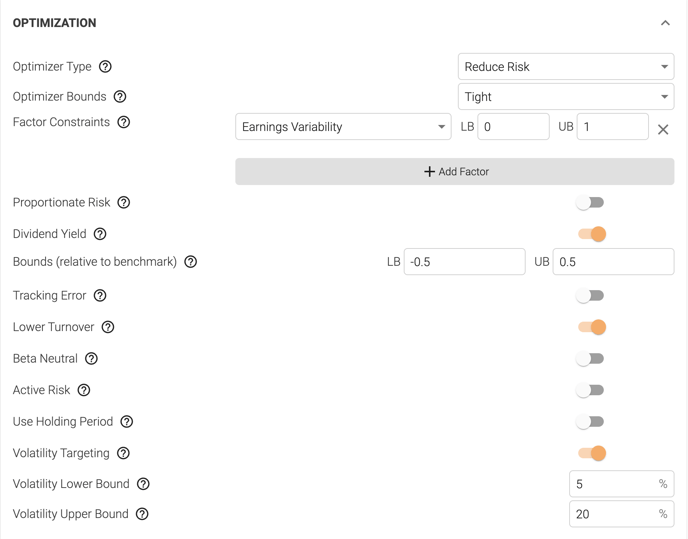

OPTIMIZATION BREAKDOWN

| Description | |

| Optimizer type | No Optimization: None |

| Reduce Risk: Optimizer designed to reduce portfolio volatility. This tends to result in the best overall performance. | |

| Maximize Sharpe: Optimizer designed to maximize Sharpe using out of sample estimates for expected return. Estimates for expected return have an outsized impact on the performance of this optimizer | |

| Maximize Sharpe V2: Optimizer designed to maximize the portfolio's exposure to the underlying signal while simultaneously minimizing exposure to volatility. | |

| Maximize Alpha: Optimizer designed to maximize expected return based on out-of-sample estimates for expected return. Estimates for expected return have an outsized impact on the performance of this optimizer. | |

| Maximize Alpha V2: Optimizer designed to maximize the portfolio's exposure to the underlying signal with no consideration of stock volatility. | |

| Min VaR - Minimize Value at Risk by looking back at the proposed portfolio over the last year and trying to minimize drawdowns. | |

| Max VaR Sharpe - Maximize Value at Risk Sharpe by looking back at the proposed portfolio over the last year and trying to maximize Sharpe by observed return for the portfolio vs observed volatility. | |

| Max VaR Sharpe V2: Maximize Value at Risk Sharpe by looking back at the proposed portfolio over the last year and trying to maximize Sharpe by maximizing exposure to signal for the portfolio vs historically observed volatility. | |

| Minimize Skew - Minimize the skew of the portfolio by trying to find a set of portfolio weightings that results in returns that are closer to the mean. | |

| Optimizer bounds | Tight: The optimizer will only allow the weightings of securities in your portfolio to stay tight (close) to their initial weighting. |

| Loose: The optimizer will allow the weightings of securities in your portfolio to move a medium amount more from their initial weighting. | |

| Wide: The optimizer will allow almost any weight between the minimum and maximum weight per long or short position. | |

| Factor constraints | Allows you to select factors and restrict the number of standard deviations the solution is away from the mean (0). For example, Momentum = Lower Bound -0.5 and Upper Bound +0.5. The portfolio will not have Momentum exposures outside of those bounds (at rebalance dates). The order of factors is important. If you have 10 constraints and it cannot solve, it will attempt again to solve with the top 9 and so on. |

| Proportionate Risk | Turn on Proportionate Risk, this ensures that the long portfolio(s) and the short portfolio(s) each match the factor constraints listed as well as the long plus short portfolio(s). |

| Dividend yield | If toggled on the optimizer will try to solve for a historical dividend yield that is: stock universe + LB < portfolio dividend yield < stock universe + UB. |

| Bounds (relative to benchmark) | The LB (lower bound) and UB (upper bound) relative to the benchmark that the optimizer should target. i.e. if stock universe dividend yield is 1% and LB = 0.5% and UB = 1% then the target yield will be 1.5% < target yield < 2%. |

| Tracking error | If toggled on the optimizer will try to solve for an expected tracking error less than the amount specified. This is done out-of-sample and the ex post tracking error will likely be higher. |

| Maximum tracking error (vs Benchmark) | Amount of ex-ante tracking error to constrain the optimizer by. |

| Lower turnover | Specific to portfolio optimization only - it adds a second goal of keeping turnover low while trying to maximize the selected optimizer type. |

| Beta neutral | If toggled on the optimizer will add or subtract units of the benchmark to get ex-ante beta to be equal to the net exposure of the portfolio. |

| Active risk | Set the portfolio optimization parameters to be relative to the score from the stock universe. i.e. if you set Momentum to 0.5 to 1.0 and the stock universe has a market cap weighed score of 0.2 then the optimizer will solve for 0.7 to 1.2. |

| Use holding period | Set any covariance or other calculations within the optimizer to use a holding period return instead of daily return series |

| Volatility Targeting | During optimization the optimizer will attempt to find a solution within the provided volatility range, based on the historical volatility for the stocks in the portfolio. Best used with optimizers that consider alpha in their objective, not Reduce Risk. Note that it might be impossible to get a final volatility within range if the upper bounds is set too low or the lower bound is set too high. |

| Volatility Lower Bound: Target a standard deviation above this number. Leaving this blank indicates there is no lower bound on volatility. | |

| Volatility Upper Bound: Target a standard deviation below this number. Leaving this blank indicates there is no upper bound on volatility |

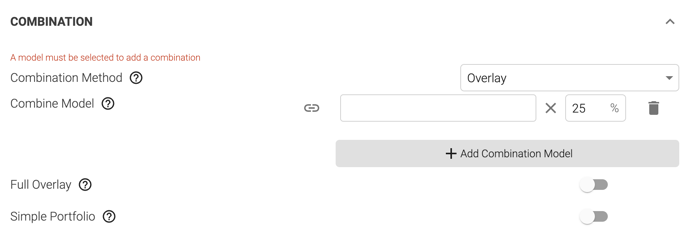

COMBINATION BREAKDOWN

| Description | |

| Combination method | Overlay: Takes a core model and overlays one or more models on top, using an intersection method. It works on a "delta" basis, where every stock pick in the models used to overlay the core model is scored from -1 to 1 (1 being the best score). You can alter the core model weights by a percentage of the delta based on that score. So a score of 0.50 will modify the core model score by 12.5% if the delta is 25%. |

| Combination: Takes a core model and combines one or more models on top, using a union method. You set a weight for each model in your groupings of models (including the core model). The scores from each of the core models are converted from -1 to 1 and then multiplied by the weight. The scores for each stock on each day are then added together. |

|

| Combine Portfolios: combines the post-optimized and constructed portfolios from 1 or more other portfolios. It is using the resultant portfolio weights as input signals – and not the machine learning signals from the models underlying the portfolios. |

|

| Combine model | The models / portfolios that you are going to combine using the selected combination methods. |

| Full Overlay: Completely overrides the "core model", effectively just using if for universe selection. | |

| Simple Portfolio: When this is selected most portfolio settings are ignored (Long %, Short %, Optimizer). Useful for looking at the performance of custom signals. |

BENCHMARK BREAKDOWN

| Description | |

| Adjust benchmark for net exposure | If your portfolio has a net exposure greater or less than 100%, this will adjust the benchmark returns to match that net exposure. |

| Benchmark | Set one or more benchmarks and the weighting for each. |

| Equal Weight Benchmark |

Instead of using the defined benchmarks, set the benchmark to be an equal weighted (per rebalance period) version of the stock universe. |

| Market Cap Benchmark |

Instead of using the defined benchmarks, set the benchmark to be a market cap weighted (per rebalance period) version of the stock universe. |

FACTORS

|

Description |

|

|

ML Model Factors |

Enables use of ML Model factors, which examine current stock data instead of historical prices. |

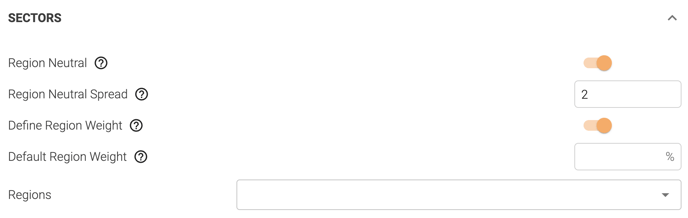

SECTORS BREAKDOWN

| Description | |

| Region Neutral | Will be constructed as a series of portfolios - each matching the market cap weighting of each of the stock universe regions. This means that min. and max. number of stocks "per portfolio" becomes "per region". |

| Region Neutral Spread | The region neutral spread is how far away from the benchmark region allocation the machine can deviate. This is adjusted for net exposure, i.e. if your net exposure is 0% the target region allocations will be 0%. |

| Define Region Weight | Define region weights, 0 will allocate a weight of 0 to that region, empty allows for free floating (default for any un-specified regions) based on market cap weighting, and any value above zero defines a weight to that region (i.e. DEU 10 = 10% to Germany). |

| Default Region Weight | Define default behaviour of an undefined weight. An empty value will mean that weight free floats, a value of x% will mean it has a x% allocation in the portfolio. |

| Sector Neutral | Will be constructed as a series of portfolios - each matching the market cap weighting of each of the stock universe sectors. This means that min. and max. number of stocks "per portfolio" becomes "per sector". |

| Sector Neutral Spread | The sector neutral spread is how far away from the benchmark sector allocation the machine can deviate. This is adjusted for net exposure, i.e. if your net exposure is 0% the target sector allocations will be 0%. |

| Name Based Sector Weighting | Base sector weightings on number of names. For example, if there are 200 names in the index and financials has 20 companies, the weight of financials should be 10% (20/200). |

| Define Maximum Sector Weights | Define maximum weights that specific sectors can have in the portfolio. |

| Define Sector Weights | Allow the user to define Sector Weights. If off it will use market cap sector weights on each rebalance day for any sector weighting decisions. If on it will use your defined weights. |

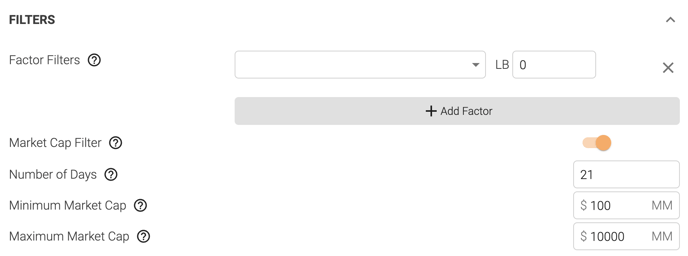

FILTERS

| Definition | |

| Factor Filters | Select a factor to set a minimum bound against. This means the machine will not consider a security eligible for investment unless it has at least a score of LB. It will be processed in the universe but cannot show up holdings. |

| Market Cap Filter | Enable a market cap filter that will not allow rankings or holdings on any security below the minimum market cap value (in millions of selected currency). |

| Number of days: Number of days over which to calculate the minimum market cap, i.e. 21 if 1 trailing month. | |

| Minimum Market Cap: Minimum market cap to allow rankings and holdings in the portfolio, in millions of selected currency in evaluation tab. | |

| Maximum Market Cap: Maximum market cap to allow rankings and holdings in the portfolio, in millions of selected currency in evaluation tab. |

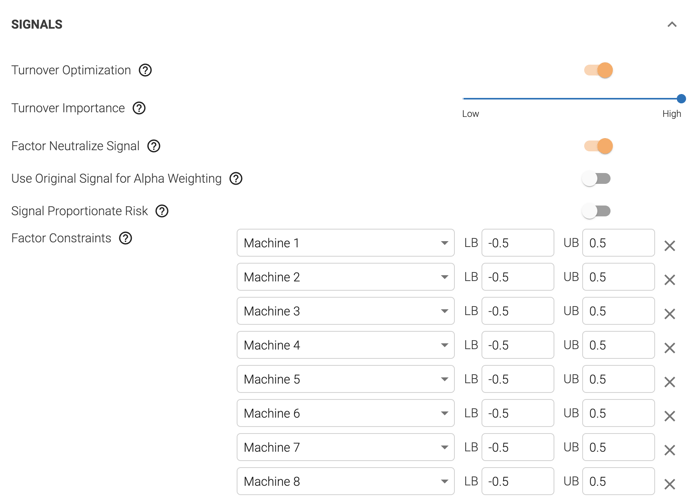

SIGNALS BREAKDOWN

| Description | |

| Turnover Optimization | Turnover optimization will reduce the turnover at the signal level, making that ranked list more stable. |

| Turnover Importance: High importance means the algorithm will aim to keep turnover low, whereas low importance on turnover will let it vary more. | |

| Factor Neutralize Signal | Turn on an optimization process that will factor neutralize the signal according to the specifications you set. This is done prior to portfolio construction (unlike Optimization) and helps reduce bias in the model. A 0 score would be neutral, so default settings are LB = -0.25 and UB = +0.25. |

| Use Original Signal for Alpha |

When both this option and alpha weighting are turned on, the factor neutralized signal will only be used to select the set of stocks in the portfolio. The original signal (before factor neutralization) will be used to weight their allocation. This option generally results in higher alpha. |

| Signal Proportionate Risk |

Turn on Signal Proportionate Risk, this ensures that the long half of the universe and the short half of the universe each match the factor constraints listed. The overall universe still respects the constraints with this turned on. |

| Factor Constraints |

Select the factors you would like the signal to be constrained by and their lower (LB) and upper (UB) bounds. |

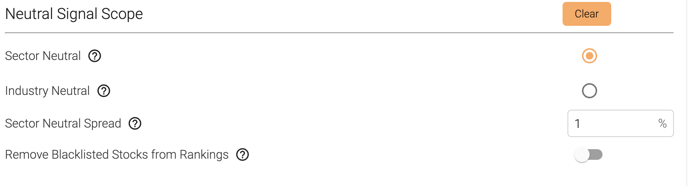

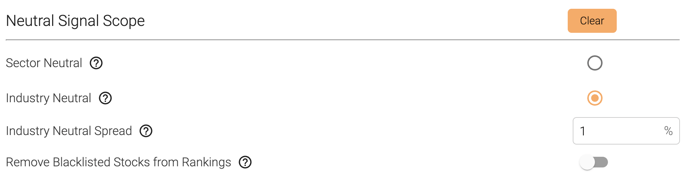

NEUTRAL SIGNAL SCOPE

| Definition | |

| Sector Neutral | Make the signal sector neutral, plus or minus the signal sector neutral spread. |

| Industry Neutral | Make the signal industry neutral, plus or minus the signal sector neutral spread. |

| Sector Neutral Spread: Make the signal neutral, plus or minus the signal sector neutral spread. | |

| Industry Neutral Spread: Make the signal industry neutral, plus or minus the signal industry neutral spread. | |

| Remove Blacklisted Stocks from Rankings | When togged on, this will erase the signals of stocks for the dates they are blacklisted for, removing them from the stock rankings. |

DENSE SIGNALS FILE

| Definition | |

| Include Forward Returns | Include forward returns for securities at each rebalance date in Dense Signals export file. |

| Include Share Quantities | Include share quantities in the Dense Signals export file. |

| Add RIC Code | Add RIC (Reuters Instrument Code) to the Dense Signals export file. |

EXPLAIN SIGNALS FILE

| Definition | |

| Explain Model | Use explain scores as the input scores, instead of using the direct scores from ML. This only works for ML models where Rank 2 has already been generated. |

| Method |

Winsorize: Clip outlier drivers' explain scores. Cutoff: Remove Outlier drivers from the model. Note: Winsorizing/Cutting is only used to generate the rankings from the explain scores. It will not change how the explain scores are displayed. |

| Threshold | If the method is Winsorize, the values that exceed the threshold score will be clipped. |

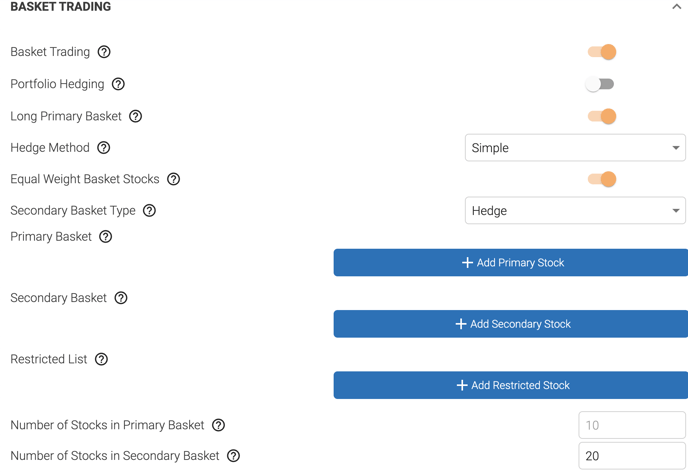

BASKET TRADING

| Description | |

| Basket Trading | Create a portfolio from specified baskets of stocks and similarity scores. |

| Portfolio Hedging | Add Portfolio: Select a portfolio to hedge. Portfolio Hedging (toggle): Toggle on to enable hedging of a portfolio. Toggle off to create customizable baskets for hedging. |

| Long Primary Basket | Toggle on to go long the primary basket of stocks, and off to go short. |

| Hedge Method |

Hedge Method: Choose between simple and optimizer. Simple: selects a basket of securities that are similar (based on the factor settings selected) to the portfolio or security you are trying to hedge. Optimizer: selects a basket of securities that are similar and attempts to minimize the exposure of the selected factors and the correlations of the resulting portfolio. |

| Equal Weight Basket Stocks | Toggle on to construct baskets with equal weighted stocks, and off to define weightings manually. |

| Secondary Basket Type |

Hedge: The most similar stocks to the primary basket are chosen and taken the opposite direction of the primary basket. Replication: The most similar stocks to the primary basket are chosen and take the same direction as the primary basket. |

| Primary Basket | Set on or more primary stocks and the weighting for each. |

| Secondary Basket | Set secondary stocks and the weighting for each. |

| Restricted List | Securities that will be restricted from being added to machine-generated portfolio at initial creation and rebalancing. |

| Number of Stocks in Primary Basket |

Specify the number of stocks in the primary basket. |

| Number of Stocks in Secondary Basket | Specify the number of stocks in the secondary basket. The machine will choose the remaining stocks that have not been manually entered. |

| Correlation | When turned on, the portfolio will generate baskets based on return correlations instead of similarity or factor scores. |

| Price Weight | How important the price similarity scores generated from Machine Factors are in constructing the baskets. |

| Data Weight |

How important the data similarity scores generated from ML Model Factors are in constructing the baskets. |

| Factor Weight | How important the traditional, non-machine factors are in constructing the baskets. |

| Beta Weight | How important Beta is in constructing the baskets. |

| ESG Weight | How important the ESG factors are in constructing the baskets. |

| Signal Importance | How important the input signals are in constructing the baskets. |